Paramount Skydance is preparing a majority-cash buyout offer for Warner Bros Discovery, according to multiple reports (via Deadline). The proposed deal would include all of Warner Bros Discovery’s assets, from HBO and CNN to Warner Bros Studios and Discovery’s global cable networks.

The news comes just weeks after Skydance Media, led by David Ellison, finalized an $8.4 billion takeover of Paramount Global. Now, with the Ellisons in control of Paramount Skydance, the company is reportedly targeting Warner Bros Discovery (WBD) as its next major acquisition.

Ellison Family to Back the Acquisition Bid of Warner Bros Discovery

The bid, first reported by The Wall Street Journal and confirmed by Deadline, is expected to be majority cash and financed by the Ellison family. It’s led by Oracle founder Larry Ellison, one of the world’s richest individuals with an estimated net worth of $367.2 billion (via Forbes).

David Ellison, now chairman and CEO of Paramount Skydance, has laid out a technology-driven strategy for media growth. It aims to scale content, merge platforms, and cut costs. The proposed acquisition of WBD would expand the company’s global footprint in both streaming and legacy media.

Warner Bros. Discovery is currently planning to split into two separate companies by April 2026: one focused on Warner Bros Studios and streaming, the other on international cable and Discovery+. The current bid is aimed at the full company before the split takes effect in April 2026. However, neither Warner Bros. Discovery nor Paramount Skydance has commented on this.

Warner Bros Stock Surged Following the Bid Report

News of the proposed acquisition sent Warner Bros. Discovery stock soaring by as much as 33 percent on Thursday. Paramount Skydance shares also rose more than 10 percent.

A merger between Paramount Skydance and Warner Bros. Discovery would unite two major Hollywood studios. It would expand the combined streaming footprint to over 200 million subscribers. As of June 2025, Max had 125.7 million subscribers, while Paramount+ had 77.7 million (via Variety).

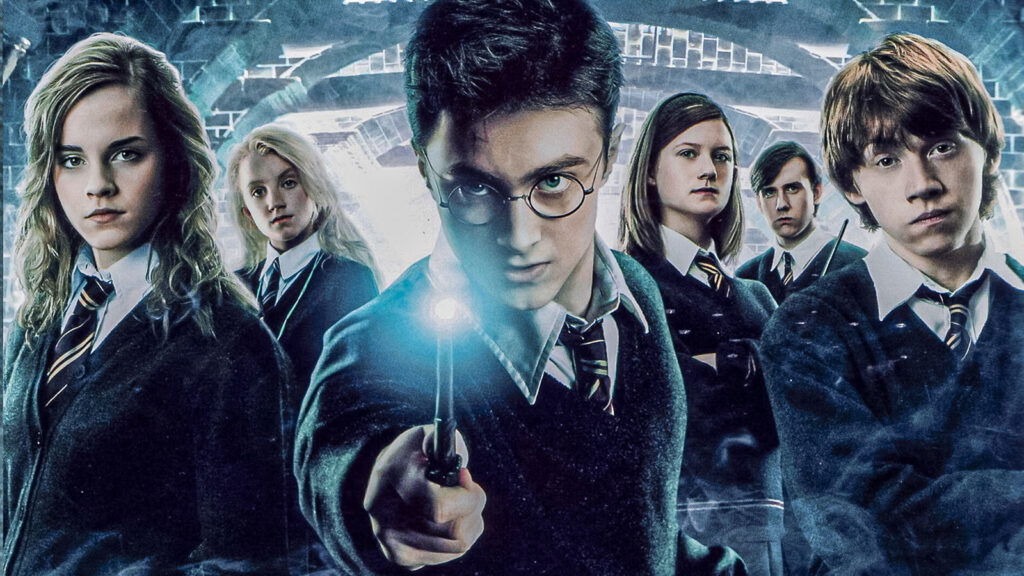

The deal would also bring together valuable intellectual property, including DC Comics, Harry Potter, Game of Thrones, Star Trek, Top Gun, and Mission: Impossible, along with top cable networks like CNN, CBS, Nickelodeon, MTV, and HGTV.

However, the deal is expected to face antitrust scrutiny from the U.S. Department of Justice. While the Federal Communications Commission is not likely to be involved, given Warner Bros. Discovery’s lack of broadcast licenses, regulators could raise concerns about competition.

If successful, the Paramount Skydance-WBD merger could reshape the future of entertainment. It can create one of the largest media companies in the world and potentially trigger a new wave of consolidation.

Will this move by the Ellison family reshape the streaming wars? Should legacy studios merge to survive? Let us know your thoughts on this merger.